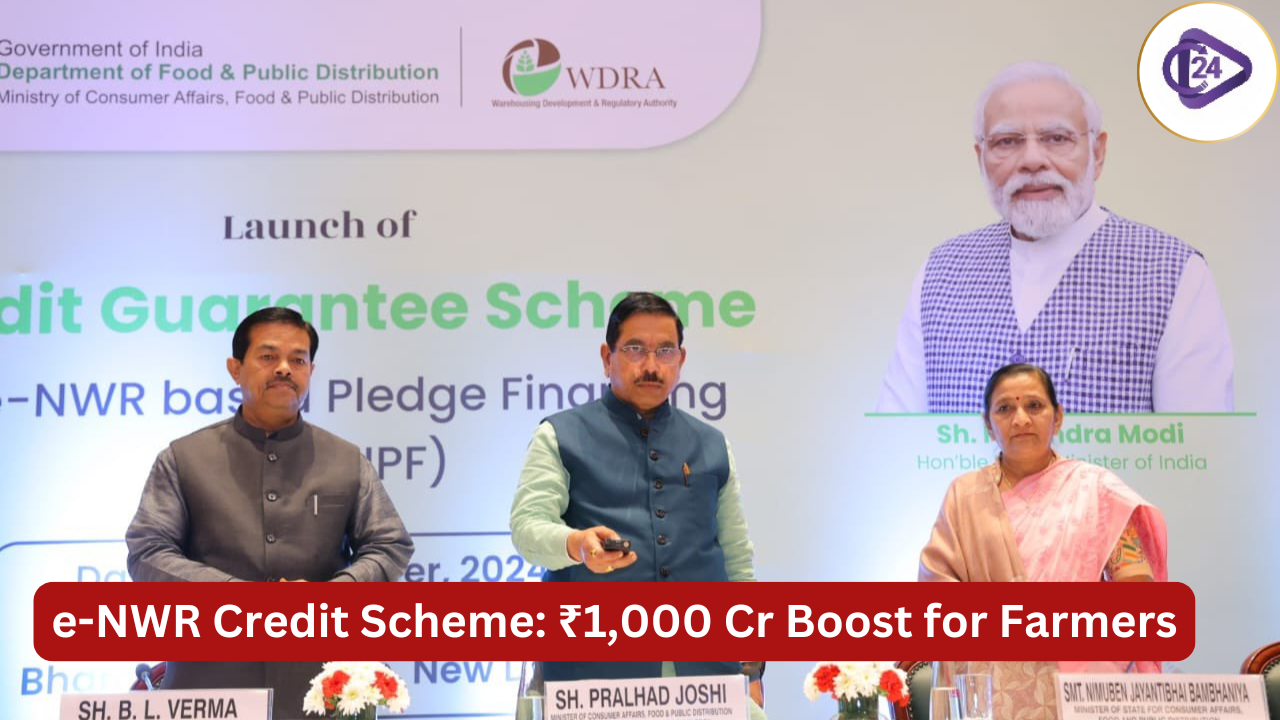

India’s food and consumer affairs minister Pralhad Joshi recently rolled out the Credit Guarantee Scheme for e-NWR-based pledge financing scheme (CGS-NPF) with a fund of Rs 1,000 crore. This scheme seeks to cut on distress selling by farmers by providing post-harvest finance using e-NWRs backed by pledged commodities whose storage is permitted by relevant warehouses. This encompasses small/marginal farmers such as women, farmer’s organizations/ SHGs-SC/ST/PwD farmers, MSMEs, traders, and FPOs. The scheme allows cubing of up to 85% in the case of farmers and up to 75% in other cases. Through this initiative, the lending fraternity has been encouraged to support farmers in post-harvesting capabilities with the resulting impact on farmers’ incomes and positive changes made to their perceptions of the banking system.

Key Highlights

Launch and Objective:

-

The Credit Guarantee Scheme for e-NWR-based Pledge Financing (CGS-NPF) was recently rolled out where to Union Minister Pralhad Joshi in the second week of December 2024.

-

Purpose: The scheme envisages alleviating distress selling by farmers through the post-harvest credit of one thousand crore against e-NWRs.

-

Target Audience: Small and Marginal Farmers, Women, SC/ ST Farmer, Disabled (PwD) Farmer, MSMEs, FPOs and Farmer Cooperatives.

Guarantee Coverage:

-

85% for loans up Rs 3 lakhs for small and marginal farmers, women SC/ST/PwD.

-

80% coverage for loans above Rs. 3 lakh but less than Rs. 75 lakh to the same above group.

-

50% guarantee for loans up to Rs. 200 lakh for other borrowers, which includes the MSMEs traders etc.

Features:

-

Total Corpus: Rs. 1,000 Crore.

-

Eligible Institutions: The two major classifications for bank are Scheduled Banks and Cooperative Banks.

-

Risks Covered: Credit risk associated with the receivables and risk associated with the warehouseman.

-

Guarantee Fee: 0.4% for farmers, 1% for non-farmers.

Financial Implications:

-

Initially, the 80-85 % guarantee will be provided on those loans that have been given up to Rs. 75 lakh to the farmers.

-

75 percent will be covered up to Rs.200 lakh for the loans given to MSMEs, traders and FPOs.

Government’s Commitment:

-

Minister Joshi said that this scheme is viable for food security and called for banks to become less conservative in funding farmers.

-

The scheme sits well with Prime Minister Mr. Modi’s agriculturist-friendly profile.

-

The platform called e-Kisan Upaj Nidhi works on bringing tailor-made lending methods targeting farmers without their frequent trips to the bankers.

Claims Settlement:

-

Loans up to Rs. 75 lakh: The first installment constitutes to 75% of the total sum of the contract while the second installment is only 25% of the total sum of the contract.

-

Loans above Rs. 75 lakh and up to Rs. 2 crore: One payment is equal to 60% of the cash and another payment corresponds to 40% of the cash.

Additional Goals:

-

Increase Warehouse Registration: It leads registered warehousing to 40,000 as the government initiates in the next 1-2 years.

-

Focus on Farmers’ Welfare: The plan is aimed at increasing working capital in post-harvest sectors, for the farmers and traders, and improving relations between the banks and the borrowers.

Conclusion

Credit Guarantee Scheme for e-NWR-based Pledge Financing is a critical initiative aimed at solving farmers' post-harvest financial challenges. With ₹1,000 crore as corpus, it ensures accessible loans, reduces distress selling, and supports small/marginal farmers, MSMEs, and FPOs. This scheme strengthens warehousing infrastructure, builds trust in banks, and aligns with the government’s commitment to rural development and food security.

Chat With Us

Indian Pharmaceutical Sector: Global Leadership for Strategic Development

Indian Pharmaceutical Sector: Global Leadership for Strategic Development Govt of India and ADB signed a $42 million loan for coastal protection in Maharashtra

Govt of India and ADB signed a $42 million loan for coastal protection in Maharashtra The Wealth Tax Debate in India: History, Challenges & Future Insights

The Wealth Tax Debate in India: History, Challenges & Future Insights Pharmaceutical Market and Initiatives in India (FY 2023-24)

Pharmaceutical Market and Initiatives in India (FY 2023-24) India Achieves $1 Trillion in FDI Milestone: A Game-Changer for Economic Growth

India Achieves $1 Trillion in FDI Milestone: A Game-Changer for Economic Growth RBI Monetary Policy 2024: Key Highlights and Framework in India

RBI Monetary Policy 2024: Key Highlights and Framework in India India’s social security scheme for gig and platform workers

India’s social security scheme for gig and platform workers Sanjay Malhotra: 26th Governor of RBI

Sanjay Malhotra: 26th Governor of RBI India Skills Report 2025: Unlocking Employability and Bridging the Skills Gap

India Skills Report 2025: Unlocking Employability and Bridging the Skills Gap