Recently, RBI Governor clarified that India has not taken steps toward de-dollarisation and is rather focused on de-risking its domestic trade from geopolitical upheavals. The current geopolitical scenario has led to many uncertainties, prompting concerns of widespread economic turmoil, but India remains committed to maintaining stability in its economic policies.

What is de-dollarization?

About: It aims to reverse dollarization (historical domination of US dollar in global market) causing a significant reduction of its use in world trade and financial transactions.

Recent Trends: Countries like India, Brazil, Russia, China, and Indonesia are opting for local currency trade to break the US dollar monopoly.

India has permitted trading invoicing in Indian Rupees (INR) with many countries, including Russia.

The recent BRICS Summit held at Kazan in 2024 also touched upon the possibility of a common BRICS currency.

Why do countries opt for De-dollarization?

Reduction of Exchange Rate Risk: It lets the countries trade in their native currencies, thereby minimizing risks arising from fluctuations in US Dollar value.

Better Control on Monetary Policy: Countries can carry out strategies that are suited to the conditions of their economy, free from US Dollar pressure.

Geo-political advantage: Shift the power dynamic to challenge US dominance and the weaponization of the dollar through sanctions, etc.

What are the issues facing De-dollarization?

Affect Financial Transactions: Since many commodities, like oil, gold, etc. are currently priced and exchanged in dollars.

Financial Instability: Suddenly shunning dollar might put the domestic currencies at risks like volatile exchange rates, expensive debts, etc. etc.

Background

During the Johannesburg Summit (2023), Brazilian President proposed a common currency for the BRICS countries. It is his argument that countries that do not use dollars should not be coerced into trading in the dollars.

- He has also clamored for a common currency in the Mercosur region of South American countries.

- The BRICS countries have considered diversifying away from using dollars for their transactions.

- E.g., India and China have been increasingly turning to alternative currencies to make oil-related settlements with Russia, making a complete bypass of the dollar.

- In the Kazan summit 2024, an illustrative BRICS banknote was unveiled

Advantages of BRICS common currency:

- BRICS avoids dependence on the U.S. dollar that dominates trade and finance in the time of sanctions.

- Economic sovereignty for BRICS as it minimizes exposure to currency fluctuations and makes BRICS more powerful in international financial regulatory governance.

- Facilitate trade amongst BRICS Nations, as a common currency simplifies transactions and reduces transaction costs.

- Common currency could further strengthen funding by the New Development Bank (NDB).

Challenges associated with BRICS common currency:

Complications in currency integration: The varied economic systems and levels of development which member states of BRICS could complicate currency integration. E.g., adoption of common currency was feasible in the European Union (EU) because of similar levels of development in Europe.

Political coordination: It is a pretty complex process to shift from the US dollar. Coordination of the monetary and fiscal policies of different countries with their political systems and priorities would be tough.

Requires coordination among Central banks: A stable common currency needs a sound economic and monetary framework as well as coordination of the Central banks of member states.

Dollar's dominance & role as Reserve Currency:

Since the end of World War II, the dollar has been the most widely used currency for international trade.

The U.S. wields a vast geopolitical leverage by controlling the global financial system, through mechanisms like SWIFT (the system banks use to facilitate international payments).

Foreign exchange reserves and international trade (particularly trade in oil and oil industry related commodities) are primarily dominated in US dollars.

A reserve currency is a foreign currency which the Central banks keep as part of their official reserves.

Countries like to hold reserves in currencies which have larger and more liquid markets, so that such reserves can be easily drawn upon.

The US Treasury market, which is the biggest and the most liquid bond market in the world, strongly underpins the dollar's supremacy.

Countries that maintain dollar reserves can borrow at cheaper rates and this also assists in keeping the borrowing rates low for the US.

Push for de-dollarisation: The world is witnessing an increasing push for de-dollarisation, even though the dollar remains dominant, for economic and geopolitical reasons.

- The global movement towards de-dollarisation is a complex, gradual process driven by geopolitical and economic realities.

Conclusion

While India is not yet pursuing full-scale de-dollarisation, the ongoing global shift towards diversifying from the US dollar highlights the need for strategic adaptation. India’s focus on "rupeefication" of trade and bolstering its domestic currency’s global presence offers a balanced approach that minimizes risks, challenges the US dollar's dominance, and ensures stability amid geopolitical shifts. By prioritizing de-risking rather than immediate de-dollarisation, India aims to strengthen its economic resilience and enhance its role in the global financial ecosystem.

RBI Retains SBI, HDFC Bank, and ICICI Bank as Domestic Systemically Important Banks

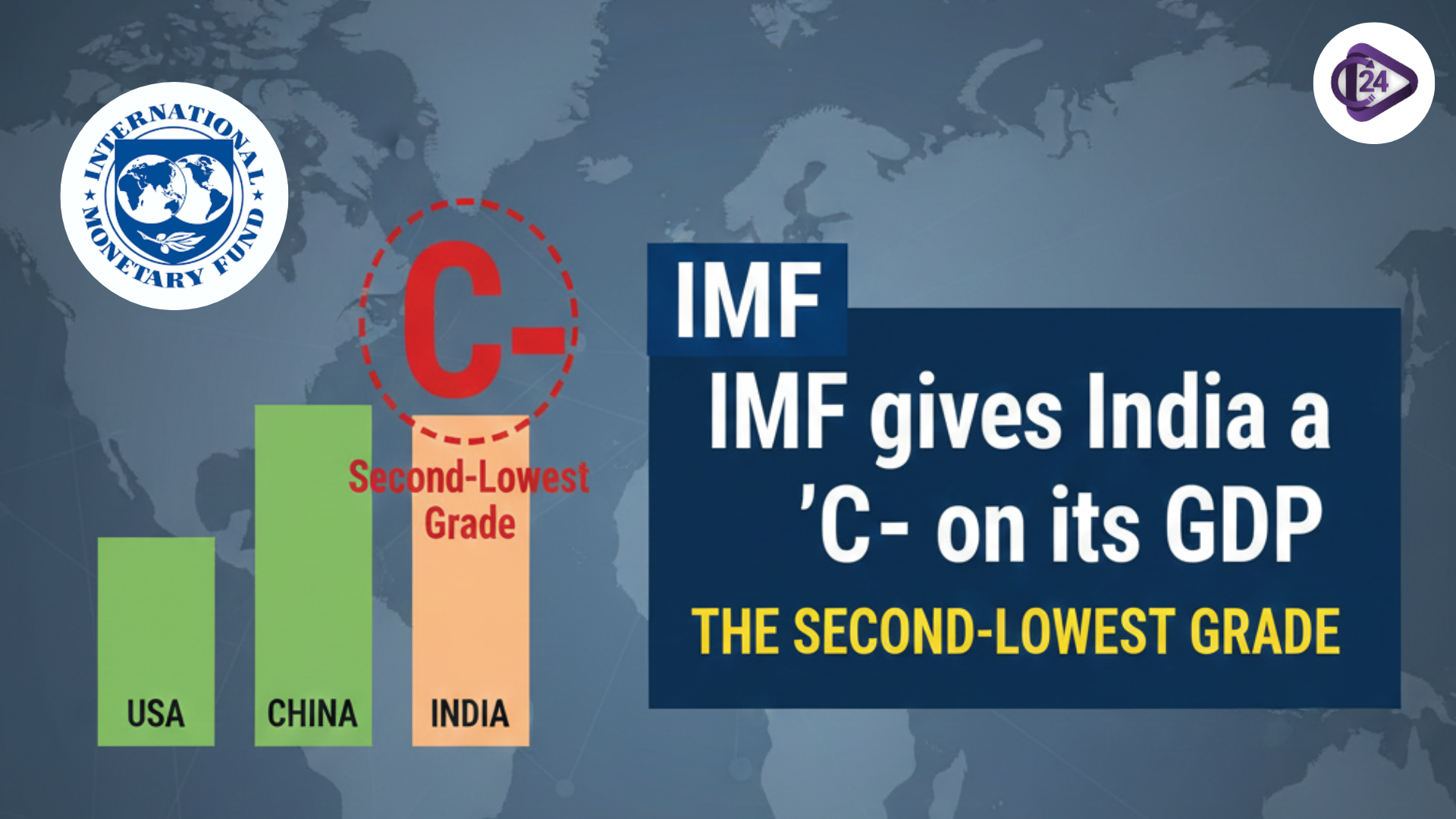

RBI Retains SBI, HDFC Bank, and ICICI Bank as Domestic Systemically Important Banks IMF gives India a ‘C’ on its GDP and other national accounts data, the second-lowest grade

IMF gives India a ‘C’ on its GDP and other national accounts data, the second-lowest grade India Witnesses Rapid Surge in Ultra-Processed Food Consumption

India Witnesses Rapid Surge in Ultra-Processed Food Consumption HDFC Bank Secures the Top Rank in India’s 2025 Brand Value Index

HDFC Bank Secures the Top Rank in India’s 2025 Brand Value Index ASSOCHAM New President Nirmal Minda to Drive Industrial Innovation and Sustainability in India

ASSOCHAM New President Nirmal Minda to Drive Industrial Innovation and Sustainability in India 8th Pay Commission 2025: Latest News, Salary Hike & DA Update

8th Pay Commission 2025: Latest News, Salary Hike & DA Update Sonali Sen Gupta Takes Charge as RBI Executive Director

Sonali Sen Gupta Takes Charge as RBI Executive Director Shram Shakti Niti 2025: India’s Future-Ready Labour Policy for Employment Growth

Shram Shakti Niti 2025: India’s Future-Ready Labour Policy for Employment Growth Secure UPI Transactions: RBI and NPCI Introduce Biometric Authentication

Secure UPI Transactions: RBI and NPCI Introduce Biometric Authentication Shirish Chandra Murmu Appointed as RBI Deputy Governor

Shirish Chandra Murmu Appointed as RBI Deputy Governor