India's economic growth has fallen short of expectations despite increased public spending focused on capital expenditures. The Economic Survey highlights that both private investment and household spending remain weak. Economic disruptions from demonetization, GST implementation, and COVID-19 restrictions have contributed to the ongoing slowdown. Addressing these challenges through strategic budgetary reforms could provide the necessary stimulus for growth.

Current Economic Situation

-

Despite heightened public spending focused on capital expenditures, India is experiencing GDP growth that falls below forecasted levels.

-

According to the Economic Survey, both private investment and household spending remain weak factors concerning its economy.

-

Economic disturbances including demonetization together with GST implementation and the prolonged COVID-19 limitations have jointly caused this slowdown.

Three Phases of Post-Reform Growth

-

1991-2004: Initial economic reforms with moderate growth.

-

2004-2011: The recent period demonstrated fast economic development alongside state welfare initiatives which combined with declining poverty across the nation.

-

2011-2023: Economic slowdown, particularly after 2019, with weak private consumption and investment.

Reasons for High Growth (2004-2011)

-

The consumption numbers of India's bottom 80% of community members grew despite the decline experienced by the population's top 20%.

-

The expansion of social welfare programs represented the essential component in which the government implemented to enhance market demand.

-

Through NREGA job creation along with wage growth became particularly noticeable in rural India.

-

Agricultural and rural development investments produced additional power to strengthen the economy.

Capital vs. Revenue Expenditure

-

Capital Expenditure (Capex): The construction of massive infrastructure elements including dams together with nuclear power plants delivers minimal short-term effects on market demand and employment levels. An increase in spending operations leads to expanded imports which decreases the overall economic benefits within the domestic country.

-

Revenue Expenditure: Public social initiatives such as NREGA and pensions are keys to increasing lower-income consumption because their multiplier effect comes directly from demand.

-

Revenue expenditure growth during 2004-2011 resulted in widespread economic advantages throughout the population.

Conclusion

To arrest the current decline in growth, India must focus on increasing both private and public sector investments, along with enhancing domestic demand. The budget needs to prioritize policies that can boost household consumption, address the disruptions caused by past economic measures, and focus on sustainable infrastructure development. Additionally, increasing social welfare programs can drive consumption in lower-income groups, strengthening the overall economy. By creating a more conducive environment for investment and consumption, the budget can play a pivotal role in turning the economic tide in India.

Tripura Gramin Bank Launches India’s First Solar-Powered ATM Van

Tripura Gramin Bank Launches India’s First Solar-Powered ATM Van India Emerges as World’s Largest Rice Producer

India Emerges as World’s Largest Rice Producer Government of India Launches ₹7,280 Crore Scheme for Rare Earth Permanent Magnets

Government of India Launches ₹7,280 Crore Scheme for Rare Earth Permanent Magnets IIFL Finance appoints ex-RBI Deputy Governor B. P. Kanungo as Chairman

IIFL Finance appoints ex-RBI Deputy Governor B. P. Kanungo as Chairman India and Oman Sign the Comprehensive Economic Partnership Agreement (CEPA)

India and Oman Sign the Comprehensive Economic Partnership Agreement (CEPA) RBI Retains SBI, HDFC Bank, and ICICI Bank as Domestic Systemically Important Banks

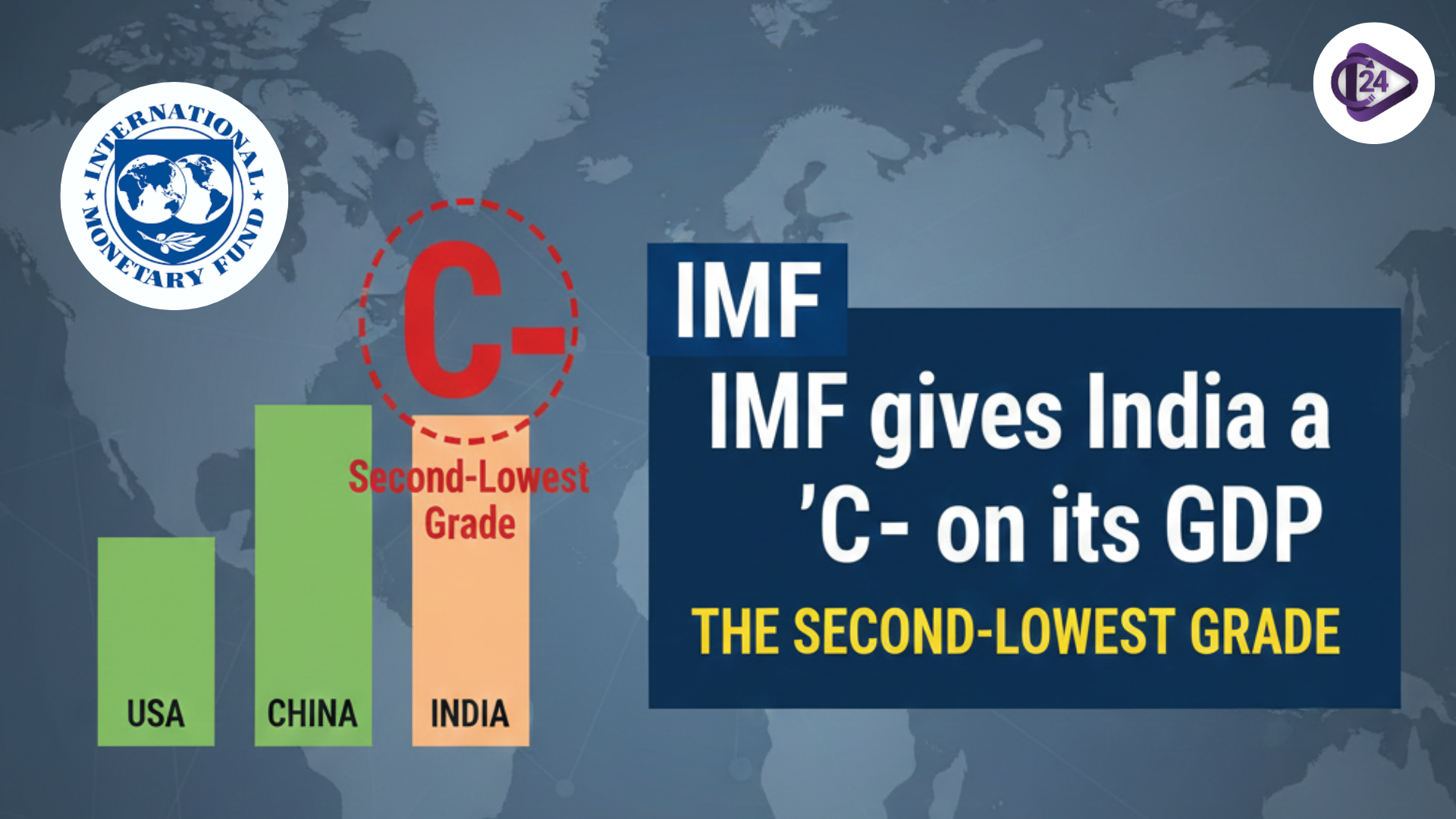

RBI Retains SBI, HDFC Bank, and ICICI Bank as Domestic Systemically Important Banks IMF gives India a ‘C’ on its GDP and other national accounts data, the second-lowest grade

IMF gives India a ‘C’ on its GDP and other national accounts data, the second-lowest grade India Witnesses Rapid Surge in Ultra-Processed Food Consumption

India Witnesses Rapid Surge in Ultra-Processed Food Consumption HDFC Bank Secures the Top Rank in India’s 2025 Brand Value Index

HDFC Bank Secures the Top Rank in India’s 2025 Brand Value Index ASSOCHAM New President Nirmal Minda to Drive Industrial Innovation and Sustainability in India

ASSOCHAM New President Nirmal Minda to Drive Industrial Innovation and Sustainability in India