India's GDP growth is forecasted to fall to 6.4% in FY 2024-25, marking a significant dip from the 8.2% growth in the previous fiscal year. The slowdown is attributed to weakening manufacturing output and lower investment growth, signaling a potential end to the post-pandemic economic boom. This projection comes from the National Statistics Office (NSO) and presents a more conservative outlook compared to the Reserve Bank of India's (RBI) 6.6% estimate. The manufacturing sector, a major contributor to India's economic engine, is expected to see limited growth.

Presented by the Ministry of Statistics and Programme Implementation, it is below the RBI’s estimate of 6.6 % for the same period. Areas that led to the slowing down are expected weaknesses in manufacturing and investment categories.

Sectoral Analysis: Also decreased manufacturing and investment decline

Manufacturing is predicted to rise by only 5.3% here, compared to 9.9% the previous financial year. Likewise, investment growth will slow down to 6.4% in FY 2023-24 from 9.0%in the previous fiscal year which depicts that there is less capital formation and industrialization.

Analysts believe that the output decline may be due to increased Input prices, global economic uncertainty, and hard monetary policies affecting these key industries. The slowing down of manufacturing activity is in tune with the global slowdown in industrial activities due to geo-political and supply chain hitches.

Bright Spot: The momentum in the agricultural sector increases

On the other hand, the growth outlook for the agriculture sector is expected to be much higher at 3.8% from 1.4 % in the previous year. This rebound is thought to have been fuelled by good monsoons and government measures to boost demand in rural areas, which should help soften business slowdown.

Actions for Policy Makers and Expenditures

These advance estimates are useful for the Government to have an idea of the economic scenario before the Union Budget. Reduced rates of GDP growth and economic revival will pose an impact on the kind of fiscal policies that would be adopted, giving rise to a kind of equipoise between the expansion of fiscal deficit and its contraction.

Recent trends and nominal growth outlook are hardly different from the above-stated empirical findings, assuming conservative intra-sample values for various parameters and screening out the outliers.

The announcement comes after the company posted growth figures from previous quarters indicating that growth was slowing. The real GDP numbers were 5.4% for the July-September quarter of 2023-24, down an 18-month low, while the real GDP had expanded 6.7% in the immediate preceding quarter.

On the other hand, nominal GDP is anticipated to continue to grow at a steady rate with a growth of 9.7% in FY 2024 -25 as compared with 9.6% in the previous FY 2023 -24.

Challenges Ahead

India’s economic situation remains a challenge due to diminishing global demand, rising inflation rates, and geopolitical risks. Asian consumers continue to be major spenders, but weak manufacturing and investment prospects show why focused policies will be needed to maintain the region’s growth pace.

Conclusion

As India predicts, it may be a year of slow economic advancement, but it remains a question for the Indian government and central bank on how to manage the current weaknesses for the strategic future stance. To tackle the projected slowdown, there’s likely to be an emphasis on increasing manufacturing, revival of investments, and guaranteed inclusive growth.

India and Oman Sign the Comprehensive Economic Partnership Agreement (CEPA)

India and Oman Sign the Comprehensive Economic Partnership Agreement (CEPA) RBI Retains SBI, HDFC Bank, and ICICI Bank as Domestic Systemically Important Banks

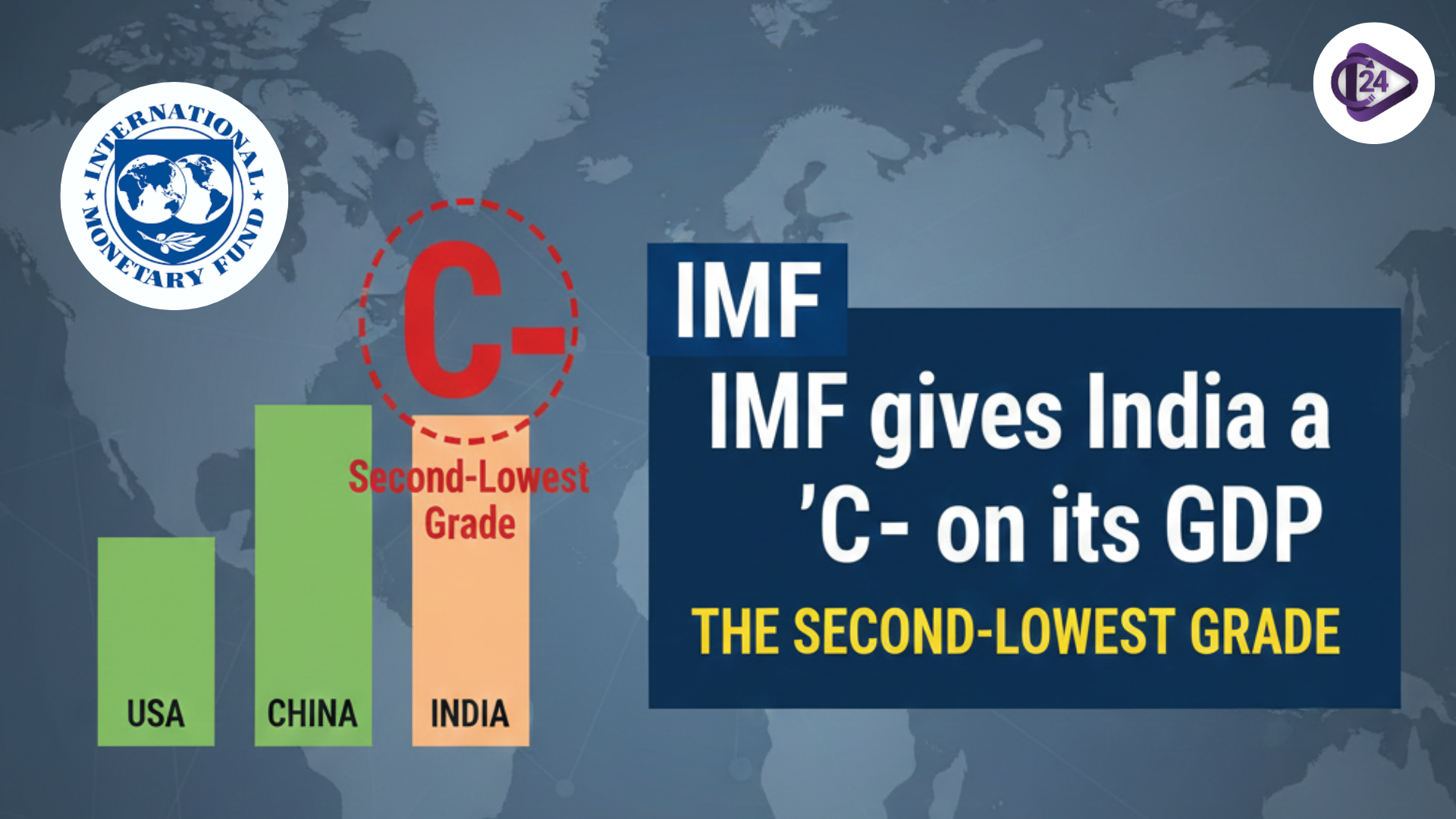

RBI Retains SBI, HDFC Bank, and ICICI Bank as Domestic Systemically Important Banks IMF gives India a ‘C’ on its GDP and other national accounts data, the second-lowest grade

IMF gives India a ‘C’ on its GDP and other national accounts data, the second-lowest grade India Witnesses Rapid Surge in Ultra-Processed Food Consumption

India Witnesses Rapid Surge in Ultra-Processed Food Consumption HDFC Bank Secures the Top Rank in India’s 2025 Brand Value Index

HDFC Bank Secures the Top Rank in India’s 2025 Brand Value Index ASSOCHAM New President Nirmal Minda to Drive Industrial Innovation and Sustainability in India

ASSOCHAM New President Nirmal Minda to Drive Industrial Innovation and Sustainability in India 8th Pay Commission 2025: Latest News, Salary Hike & DA Update

8th Pay Commission 2025: Latest News, Salary Hike & DA Update Sonali Sen Gupta Takes Charge as RBI Executive Director

Sonali Sen Gupta Takes Charge as RBI Executive Director Shram Shakti Niti 2025: India’s Future-Ready Labour Policy for Employment Growth

Shram Shakti Niti 2025: India’s Future-Ready Labour Policy for Employment Growth Secure UPI Transactions: RBI and NPCI Introduce Biometric Authentication

Secure UPI Transactions: RBI and NPCI Introduce Biometric Authentication