The Indian government granted tax-free status to several components needed for EV battery and mobile phone production. The upcoming financial year’s budget introduces these measures to support domestic production while improving export capabilities along with protection against US trade restrictions. This change will support Indian manufacturers and strengthen the country's trade talks with the US authorities.

Key Points:

-

The Finance Minister Nirmala Sitharaman included in the Finance Bill 2025 a policy which eliminates import tariffs on specific raw components needed for EV battery and mobile phone production.

-

As part of the exemption policy a complete list containing 35 items for EV battery manufacturing as well as 28 items for mobile phone production received duty-free import status.

Economic Impact:

-

This policy boosts domestic production alongside the ‘Make in India’ programs.

-

Indian export products gain enhanced competitiveness because of this measure.

-

The initiative will create offsetting actions against the US-imposed reciprocal trade measures.

Strategic Trade Talks:

-

The Indian government carries on talks with the US to resolve issues related to tariffs.

-

The Indian government plans to lower taxes on about $23 billion worth of US imports during trade discussions.

Parliamentary Recommendations:

-

A parliamentary committee in India recommended lowering tariffs on raw materials because it would assist Indian manufacturers.

Additional Amendments in Finance Bill 2025:

-

Abolishment of the 6% Digital Advertising Tax.

-

A new Income Tax Bill will replace the 1961 Act when it enters the Monsoon Session.

-

The government plans to allow Income Tax officers to inspect digital records for conducting evaluations.

Customs Strategy:

-

The customs strategy aims to simplify tariff rates in order to avoid product tax inversion when inputs cost more than finished goods.

-

Indian government should develop strategies to enhance value-based production within the country which promotes national industries.

-

The government works to enhance the 'Make in India' program as a way to increase domestic manufacturing activities.

About Electric Vehicles:

-

Electric Vehicles operate with electric motors and storage batteries provide power to these motors. EVs differ from ICE vehicles through their emission-free operation and elimination of fuel modules such as pumps and fuel lines and tanks.

-

The use of EVs supports Goal 7 of Sustainable Development with its mission to deliver affordable energy to all together with dependable sustainable power. The promotion of renewable energy eliminates India's fossil fuel dependency while following the 'Panchamrit' targets established at COP26.

Current Status of E-Mobility in India:

-

The Bureau of Energy Efficiency (BEE) reports EV sales in India represent smaller than one percent of total vehicle market activity.

-

Indian roadways consist mainly of traditional automotive transportation while electric two-wheelers represent 0.4 million units and electric cars stand at a few thousand.

-

The Government task force known as NITI Aayog has specified that India seeks the following targets regarding EV adoption:

-

40% for buses

-

30% for private cars

-

70% for commercial vehicles

-

80% for two-wheelers by 2030

-

Why are EVs Crucial?

-

Environmental Benefits:

-

Because electric vehicles produce zero exhaust emissions they help decrease both airborne pollutants and the formation of smokey air and worldwide climate changes.

-

The decrease in environmental pollutants such as CO2, NOx, PM and VOCs creates better conditions for public wellness.

-

-

Energy Security:

-

Reduces dependence on oil imports.

-

The system supports operating with renewable power resources including solar and wind.

-

-

Technological Advancements & Job Creation:

-

The transportation industry improves through innovations in electric drivetrains and battery technology together with progress in charging system construction.

-

The manufacturing sector of batteries alongside renewable power production and charging technology network development creates new employment opportunities.

-

-

Cost Savings:

-

Operating costs decrease because electric power costs less than diesel and gasoline fuel.

-

Electric vehicles reduce maintenance expenses since they avoid additional equipment that requires movement.

-

-

Urban Mobility Solutions:

-

Since shared mobility becomes more accessible the problem of congestion and parking spots decreases.

-

The small size of EV vehicles enables optimal efficiency in urban travel.

-

Challenges Associated with E-Mobility in India:

-

Limited Environmental Benefit:

-

The adoption of fossil fuel-based electricity in India diminishes the environmental benefits that electric vehicles were meant to offer.

-

ECO-Union forecasts EVs will provide minimal carbon emission benefits since the current power generation mix lacks clean energy sources.

-

-

Range Anxiety & Infrastructure Bottlenecks:

-

Drivers experience anxiety because there are insufficient places to charge their vehicle batteries.

-

The current count of charging stations in India reaches only 1,800 while most of those stations operate in metropolitan regions.

-

Charging infrastructure costs large sums of money while stressing out national power systems.

-

-

Higher Tyre Emissions:

-

Ev vehicles with high mass generate additional particulates due to tire wear.

-

-

Battery Supply Chain Issues:

-

Most Indian battery manufacturing occurs in China where they provide 77 percent of total supply.

-

High raw material costs and a lack of recycling infrastructure.

-

-

Regulatory Hurdles:

-

The European Union will affect Indian export markets through its new Carbon Border Adjustment Mechanism (CBAM).

-

Government Initiatives to Promote EV Adoption:

New Electric Vehicle Policy 2024

-

Faster Adoption and Manufacturing of Electric Vehicles (FAME) Scheme II

-

National Electric Mobility Mission Plan (NEMMP)

-

National Mission on Transformative Mobility and Battery Storage

-

Production Linked Incentive (PLI) Scheme

-

Go Electric Campaign

-

The EV30@30 campaign receives Indian endorsement because the nation wants to reach a minimum of 30% EV sales by 2030.

Possible Ways to Boost E-Mobility in India:

-

Boosting Renewable Energy:

-

The support for clean energy comes from two national programs: National Green Hydrogen Mission and Global Biofuel Alliance (GBA).

-

Through PM-KUSUM the government strives to expand solar energy production facilities which can support EV charging infrastructure.

-

-

Expanding Charging Infrastructure:

-

The installation of additional charging stations must include rural locations.

-

The implementation of battery swapping stations will help users reduce their charging time.

-

PLI scheme addresses the problems related to charging station installation.

-

-

Encouraging Domestic Battery Manufacturing:

-

The nation aims to decrease foreign dependence through homegrown manufacturing.

-

The FAME II scheme provides support for battery production throughout India.

-

-

Addressing Battery Disposal Challenges:

-

A responsible system must be established for battery recycling operations.

-

The new Electric Vehicle Policy 2024 together with the Vehicle Scrappage Policy has been introduced to handle battery waste disposal across the nation.

-

Conclusion:

The waiver of import taxes on manufacturing materials for key components enables India to pursue its economic plan for domestic sector growth and international market position. This change in regulations will lower production expenses for manufacturers and improve foreign investment while boosting India’s trade position in international discussions. The country maintains its path towards economic self-reliance and export dominance by minimizing reliance on foreign import costs.

Free Speech as an Integral Part of a Healthy and Civilised Society

Free Speech as an Integral Part of a Healthy and Civilised Society Roshni Nadar Becomes First Indian Woman in World’s Top 10 Richest Women

Roshni Nadar Becomes First Indian Woman in World’s Top 10 Richest Women Commemorative Postage Stamp Issued in Honor of Mata Karma from Raipur

Commemorative Postage Stamp Issued in Honor of Mata Karma from Raipur Supreme Court Stays Allahabad HC’s ‘Inhuman’ Rape Attempt Remarks

Supreme Court Stays Allahabad HC’s ‘Inhuman’ Rape Attempt Remarks First-Ever Export of Anthurium Flowers from Mizoram to Singapore

First-Ever Export of Anthurium Flowers from Mizoram to Singapore Remembering Ram Manohar Lohia on His Birth Anniversary

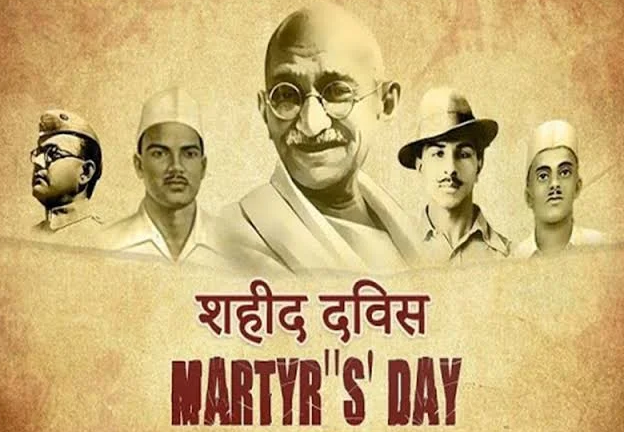

Remembering Ram Manohar Lohia on His Birth Anniversary Shaheed Diwas 2025: Honoring Bhagat Singh, Rajguru & Sukhdev’s Sacrifice

Shaheed Diwas 2025: Honoring Bhagat Singh, Rajguru & Sukhdev’s Sacrifice Where Viksit Bharat Meets Green Growth

Where Viksit Bharat Meets Green Growth Improving TB Treatment Success Rates in India: A Path to Eradication

Improving TB Treatment Success Rates in India: A Path to Eradication