India remains the leading spice producer yet ranks last in the $14 billion seasoning market since it controls only 0.7% of the global spice market behind China (12%) and the U.S. (11%). The experts have pointed out that raising production volumes and exporting more goods and creating additional value in spices remain essential for India to meet its $10 billion export target by 2030. WSO endorses three strategic market advances including: value-added spice development, nutraceutical and pharmaceutical pursuits and supports investment in resistant climate spices and environmentally friendly agricultural approaches.

The Spice Export Market of India faces multiple obstacles alongside several new business opportunities

India’s Low Share in Global Seasoning Market:

-

Spices form India's primary exports together with being its leading producer yet this production employs just 0.7 percent of India's global seasoning market which China possesses 12 percent and the U.S. holds 11 percent.

-

The establishment produces $20 billion from global spice trade while Indian seasoning exports reach $14 billion.

-

The spice industry in India generates $4.5 billion through exporting 1.5 million metric tons thus commanding 25% of the worldwide spice market.

Need for Value Addition

-

The Indian spice export sector consists of 48% value-added products alongside 52% whole raw spices being exported.

-

The achievement of $10 billion exports by 2030 demands that value-added spice exports expand to reach 70% of the total.

-

The process of value addition in the spice industry consists of spice blends extraction of essential oils as well as nutraceutical and pharmaceutical applications.

Expanding Spice Production in Emerging Regions

-

New spice production areas in North East India together with Odisha and Jharkhand regions have started demonstrating significant increases in their production figures.

-

The 15 agro-climatic zones in India provide suitable conditions to grow diverse spices throughout its different states.

-

Even though India possesses favorable conditions for spice production it fails to reach export levels so production must increase.

Cost, Quality, and Sustainability Challenges

-

Indian market competitiveness suffers from both expensive production expenses and poor quality management in global marketplaces.

-

FPOs (Farmer Producer Organizations) receive training on pesticide management as well as sustainable farming practices and water resource control.

-

The long-term development of the spice industry needs the implementation of high-yielding varieties resistant to changing climates.

Exploring New Market Segments

-

Indian spices hold wide opportunities within both the pharmaceutical and nutraceutical business sectors.

-

Modern medical practices along with Ayurvedic traditions currently employ multiple Indian spices for both health-related and medicinal purposes.

-

The expansion of functional food applications through research and development work will probably drive export growth.

Conclusion

The global seasoning market together with the value-added spice markets represent major undeveloped opportunities for India's spice sector. The achievement of India's $10 billion export target requires increased production rates alongside lowered costs combined with product quality improvements coupled with product diversification to advanced products. Sustainable farming investment alongside climate-resistant variety research combined with farmer training programs will create the most effective pathway for India to secure large global market share positions. India will establish its position as a worldwide leader in seasoning and nutraceuticals and pharmaceuticals by successfully overcoming its present obstacles.

India Emerges as World’s Largest Rice Producer

India Emerges as World’s Largest Rice Producer Government of India Launches ₹7,280 Crore Scheme for Rare Earth Permanent Magnets

Government of India Launches ₹7,280 Crore Scheme for Rare Earth Permanent Magnets IIFL Finance appoints ex-RBI Deputy Governor B. P. Kanungo as Chairman

IIFL Finance appoints ex-RBI Deputy Governor B. P. Kanungo as Chairman India and Oman Sign the Comprehensive Economic Partnership Agreement (CEPA)

India and Oman Sign the Comprehensive Economic Partnership Agreement (CEPA) RBI Retains SBI, HDFC Bank, and ICICI Bank as Domestic Systemically Important Banks

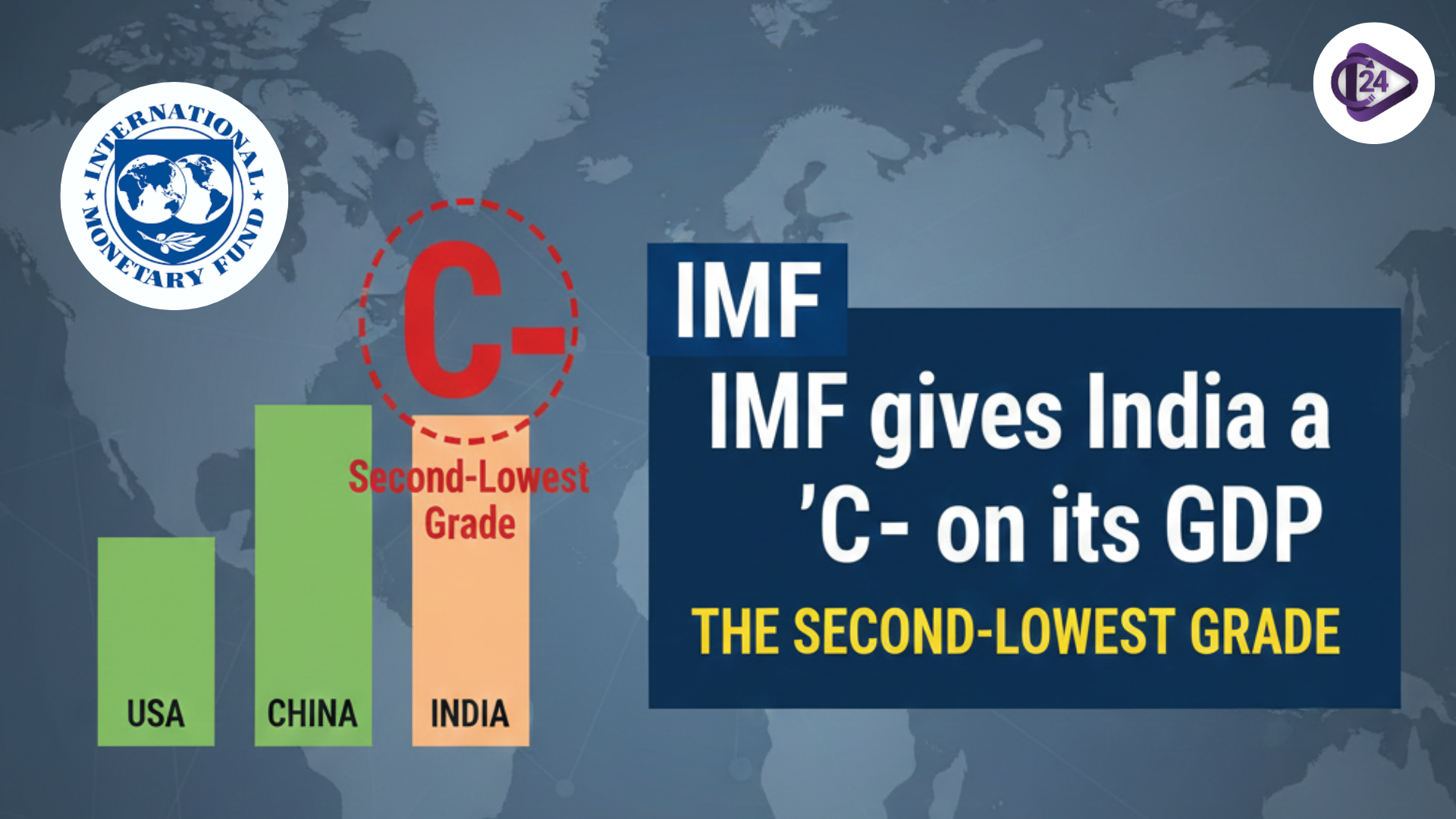

RBI Retains SBI, HDFC Bank, and ICICI Bank as Domestic Systemically Important Banks IMF gives India a ‘C’ on its GDP and other national accounts data, the second-lowest grade

IMF gives India a ‘C’ on its GDP and other national accounts data, the second-lowest grade India Witnesses Rapid Surge in Ultra-Processed Food Consumption

India Witnesses Rapid Surge in Ultra-Processed Food Consumption HDFC Bank Secures the Top Rank in India’s 2025 Brand Value Index

HDFC Bank Secures the Top Rank in India’s 2025 Brand Value Index ASSOCHAM New President Nirmal Minda to Drive Industrial Innovation and Sustainability in India

ASSOCHAM New President Nirmal Minda to Drive Industrial Innovation and Sustainability in India 8th Pay Commission 2025: Latest News, Salary Hike & DA Update

8th Pay Commission 2025: Latest News, Salary Hike & DA Update