The current list of Domestic Systemically Important Banks (D-SIBs) has recently been released by the Reserve Bank of India (RBI) proving that it’s essential for India to keep its economy stable and healthy. Opted for as ‘Too Big to Fail’ or TBTF, D-SIBs are the institutions that entail high scale vulnerability if they collapse severing the economy due to their size, structure and interlinkage with other banking firms.

On the new calibration, SBI is positioned in Bucket 4 signifying the highest amount of systemic significance. HDFC Bank has been placed under Bucket 3, whereas, ICICI Bank has been placed under Bucket 1, which interpret of lower SI level comparing to SBI and HDFC. The tiering takes an assessment of the systemic importance scores , which consider size, substitutability and interconnectedness of the banks.

Basel III regulations set higher regulatory requirements for the D-SIBs to meet. There are such measures as increasing the relative capital levels, stressing the key balance sheet elements, and developing recovery and resolution strategies. The extended supervision helps those banks be prepared to absorb losses that might come in the process of financial crises with less negative impact on the depositors and economy.

The D-SIB framework matches international methods and focuses on the financial stability of a country which is important for the growth of India’s economy. To achieve this, the RBI seeks to strengthen these financial banks in a bid to enhance confidence in the country’s banking system especially when there is enhanced financial crises in the global financial market.

It also brings out the increasing systematic significance of private sector banks including HDFC Bank and ICICI Bank. By so doing, it brings out the fact that due to changing complexity of the banking sector in India, including elements of digital and globalization; there is need to design responsive regulatory mechanism.

Relevance: Like Indian economy, banking reforms and financial stability: it becomes a very important topic for SSC and UPSC aspirants in terms of the sections. This one very much addresses a common topic that tends to arise in many competitive exams – the relation between regulation and economic development.

Chat With Us

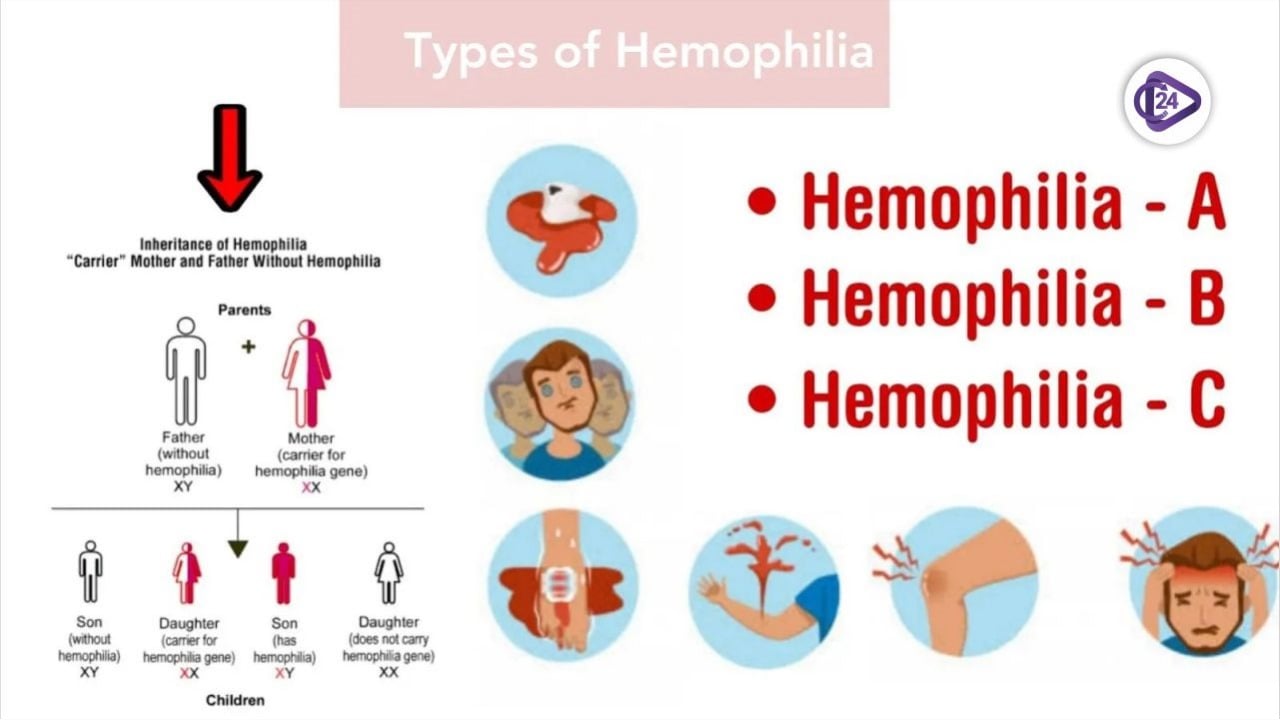

Gene Therapy for Hemophilia A: A Major Breakthrough in India

Gene Therapy for Hemophilia A: A Major Breakthrough in India Ladakh Growth Plans 95 Job Reservation Key Reforms

Ladakh Growth Plans 95 Job Reservation Key Reforms India Australia ECTA Trade Investment Partnership

India Australia ECTA Trade Investment Partnership world toilet day 2024 sanitation peace stability

world toilet day 2024 sanitation peace stability FSSAI Regulations Lab Grown Meat India

FSSAI Regulations Lab Grown Meat India India Greece Collaboration IMEEC Global Connectivity

India Greece Collaboration IMEEC Global Connectivity Andaman Nicobar Tuna Export Blue Economy

Andaman Nicobar Tuna Export Blue Economy Andhra Pradesh Natural Farming Model Sustainable Future

Andhra Pradesh Natural Farming Model Sustainable Future Largest Coral Colony Discovered Solomon Islands

Largest Coral Colony Discovered Solomon Islands