The newly established Tata Electronics semiconductor plant in Assam is a great leap in making India capable of producing its semiconductors. It has a very large production and technologically sophisticated capability and will supply industries both at home and abroad, thus replacing imports and enhancing the nation‘s competitiveness in the world markets.

Although India has daunting challenges such as high capital intensity, lack of technology, inadequate supply ability and many more, the increasing demand, and the shifting of geopolitics all encourage growth. The governemnt policies such as PLI scheme and the concept of Silicon Corridor for developing a pool of semiconductor ecosystem are also in progress.

Key Points

-

Production Timeline: To be constructed and should be competed by the year 2025 and production to start in 2026.

-

Scale: Located spanning over 220 acres of land and is India’s largest semiconductor plant

-

Production Capacity: Semiconductor chips up to 48 million of chips per day using some of the most sophisticated Semicon to include flip chip and Integrated System in Package (ISIP).

-

Industries Served: Automobile and telecom sectors; chips will be exported to Japan the USA and Germany.

-

Employment: producer of direct/indirect employment with residential accommodation for 40,000 employees in an electronics city.

Significance

-

Self-Reliance: Reduces a direct import dependency of India on the global market.

-

Regional Development: Present North-East states as planned for future under ‘Ashta Lakshmi’ vision.

-

Economic Growth: Supports the local economy of the lands and enhances India’s market in semiconductor production.

Introduction to India’s Semiconductor Industry

-

Dependence on Imports: In 2023-24, India import worth ₹ 1,71,000 crore, from Taiwan and China prominently.

Government Initiatives:

-

Production Linked Incentive (PLI) Scheme to lure the global Original Equipment Manufactures (OEMs).

-

Silicon Corridor in the three states of Gujarat, Karnataka and Tamil Nadu.

-

Semicon India program emphasizing on display and semiconductor.

Barriers in the Indian Semiconductor Sector

-

Capital Intensive: Expenditure amounts over $10 billion with long time gestation period.

-

Technological Gaps: This can easily be credited to their lack of cutting edge fabrication technologies such as 3nm and 5nm nodes.

-

Supply Chain Deficiency: Lack of silicon resources both at domestic as well as import dependency.

-

Global Competition: The key competitive threats with new competitors like the Taiwan, South Korea and the U.S.

-

Skilled Workforce Shortage: Deficiency in state of the art skill in the production of semiconductors.

Opportunities for Growth

-

Geo-Political Shifts: The tension that the world has for Taiwan is likely to work to India’s advantage as it tries to lure investors.

-

Rising Demand: High demand for semiconductors in the wake of 5G, IoT,s and Artificial Intelligent.

-

Government Support: Schemes like Make in India, PLI, and inducements to private investment.

Suggestions for Improvement

-

Infrastructure Development: Design special semiconductor zones.

-

Workforce Upskilling: Implement measures that would lead to the development of training that would focus on the workings of semiconductor manufacturing.

-

Global Partnerships: Images 15 The organization should engage the likes of the U.S. and the EU in support of more manufacturing of semiconductors.

About Semiconductor Chips

-

Applications: Having applications in most modern gadgets such as smartphones, computers, vehicles, and most medical equipment.

-

Materials: Mainly fabricated from silicon, and involve some unique steps such as design, fabrication, testing, and packaging.

Conclusion

With such environmental understanding, it is feasible to conclude that to achieve the maximum development of the semiconductor industry in India there is a need to concentrate on infrastructure solutions, R&D spending, and workforce management. Depending on schemes, developing international partnerships, and integrating sustainable infrastructure the strategy identified that aimed at building a competitive and resilient semiconductor industry. Such endeavours shall not only suffice the domestic needs but also help India in carving a place in the global semiconductor value chain.

Chat With Us

V Narayanan Appointed as ISRO Chief and Secretary of the Department of Space

V Narayanan Appointed as ISRO Chief and Secretary of the Department of Space Modhweth Festival of the Toda Tribe: A Cultural Celebration in Nilgiris

Modhweth Festival of the Toda Tribe: A Cultural Celebration in Nilgiris Launch of India First Organic Fisheries Cluster in Sikkim

Launch of India First Organic Fisheries Cluster in Sikkim Tamil Nadu CM Offers $1 Million to Decode Indus Valley Script

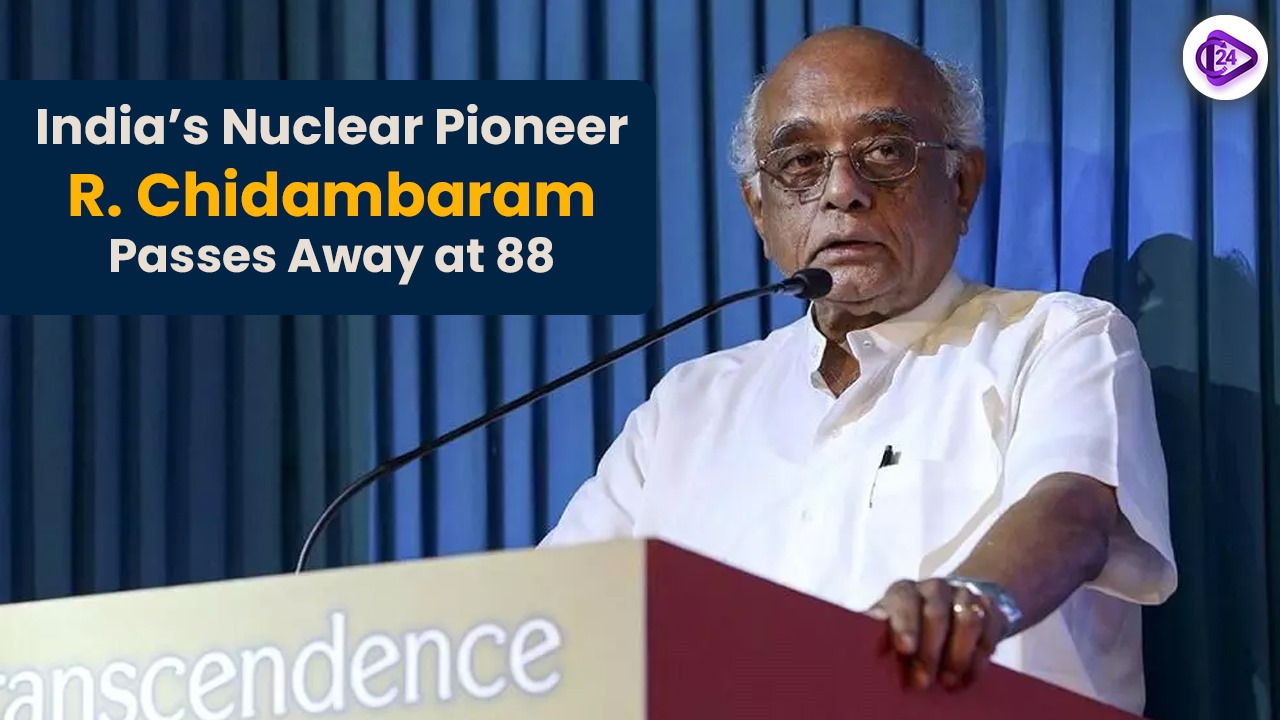

Tamil Nadu CM Offers $1 Million to Decode Indus Valley Script Dr. R. Chidambaram, Architect of India Nuclear Program, Passes Away

Dr. R. Chidambaram, Architect of India Nuclear Program, Passes Away World Braille Day: Celebrating Inclusion, Innovation & Independence

World Braille Day: Celebrating Inclusion, Innovation & Independence Nano-formulated melatonin: Possibly, the Parkinson disease therapy breakthrough

Nano-formulated melatonin: Possibly, the Parkinson disease therapy breakthrough Tamu Lhosar: Nepalese New Year Celebration and Cultural Heritage

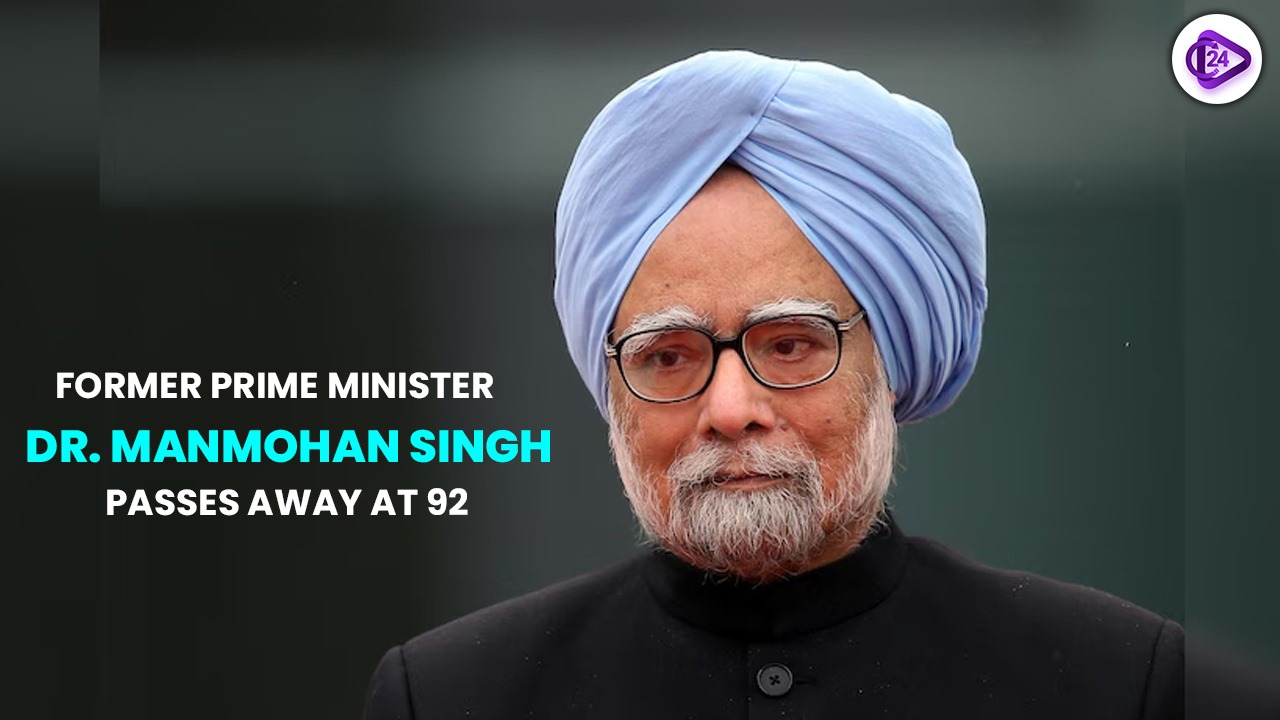

Tamu Lhosar: Nepalese New Year Celebration and Cultural Heritage Dr. Manmohan Singh, Former Prime Minister of India, Passes Away

Dr. Manmohan Singh, Former Prime Minister of India, Passes Away