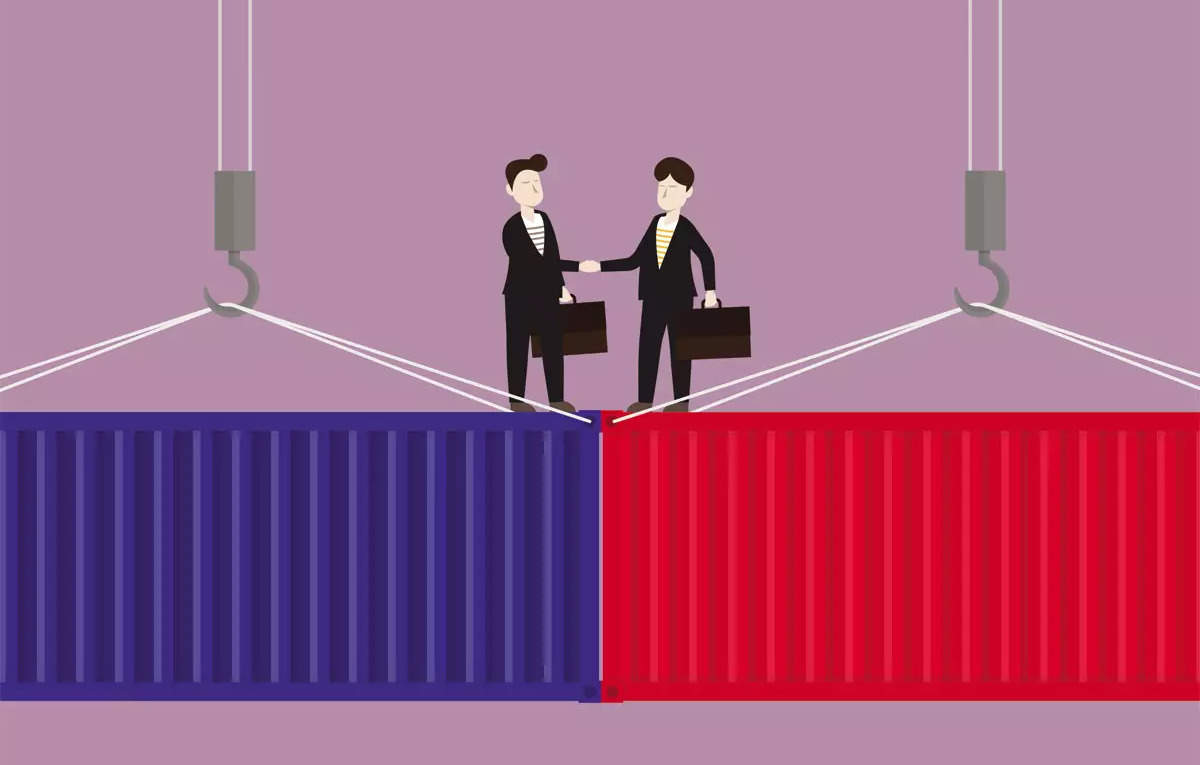

The U.S President-elect; Donald Trump has threatened to slap tariffs of up to 60% on Chinese imports in efforts to reduce the increasing trade imbalance between the two countries and to wrestle with subsidies china offers its industries. This lengthy fiscal move works towards lowering down America’s reliance on China as the latter aims at making the Chinese products less appealing to Americans in order to buy more locally produced products.

Objective and Rationale: The trade relations between the U.S.A and China have been another contentious issue with those opposed to Chinese imports consistently accusing the country of hoovering up the-Americans manufacturing and job markets. High tariffs were set by the United States government, as they consider that their local producers are losing their market to cheap products from China that are actually subsidized. This move is also viewed in an attempt to help revive the American economy and minimize importation from other countries.

Potential Impacts:

Economic Effects: There is a possibility that alarm bells starting ringing almost immediately, so the tariffs may lead to an increase in the prices of Chinese goods in the United States in the near future. For instance, take a shirt that costs $100 today; tomorrow this same shirt may be priced at $110, and this directly affects Americans. This situation may lead to short term price increase, especially on products that depend more on China for their imports.

Trade Deficit Reduction: On the little plus, and or lesser negative effects, the tariffs can assist in the reduction of the US-Chin trade imbalances, the increase of green back value, and balance the inflation rates in the long run.

Boost to Domestic Industry: The measure should kindle manufacturing at a domestic level something that will make the American products to be more competitive as compared to the imported products.

Concerns and Criticism: The proposed tariffs have their risks. A significant risk is the possibility of a new round of a trade war in which China may raise tariffs on imports from the United States or communicate support to exporters from its country. Such actions could incline to a global trade war resulting into complications of the international supply chain and worst, affect trade relations.

Also, there is a vulnerability to negative impact on various American companies that rely on Chinese inputs and parts. Such costs may reduce their competitiveness in the global market to absorb the cost of the new system. Moreover, some economic effects are formed values, including possible currency devaluation in China in response to the turning of tariffs, which will deepen the relations between the two states.

Broader Implications: This issue corresponds to globalization as it measures more than international relations through international trade as well as the dependence of one state or country on the other. The action is not just for two countries, United States and China, but also for a number of other countries that may become involved in the trade dispute. ;s Some changes in trade policies in the global level have far reaching consequenses of international relations and economic structures.

In their preparation for the SSC and UPSC both aspects on the context of economic, geopolitics and trade policy measures to be provided on such understanding of the manoeuvrability of global economic relation provided by such measures. Thus, comprehension of this case will also assist in the development of stable views towards protectionism / free trade controversies.

Chat With Us

Nepal Bangladesh Power Cooperation Via India

Nepal Bangladesh Power Cooperation Via India Australia Mates Scheme Indian Graduates Career Opportunities

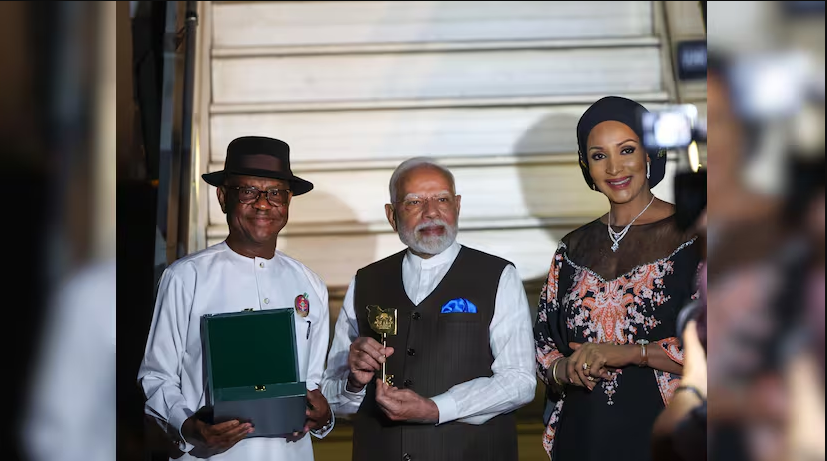

Australia Mates Scheme Indian Graduates Career Opportunities PM Modi Three-Nation Tour 2024

PM Modi Three-Nation Tour 2024 India and Japan Sign MoI for UNICORN Masts

India and Japan Sign MoI for UNICORN Masts NPP Victory Sri Lanka Parliamentary Elections

NPP Victory Sri Lanka Parliamentary Elections Amnesty Sudan Arms Embargo Violations

Amnesty Sudan Arms Embargo Violations Samantha Harvey Wins the 2024

Samantha Harvey Wins the 2024 Shift Local Currency Trade India Russia

Shift Local Currency Trade India Russia Global CO2 Emissions Rise in 2024

Global CO2 Emissions Rise in 2024