India’s GDP growth declined to 5.4% in the second quarter of 2024 to become the weakest quarterly rate recorded in the country in the last seven quarters. The Gross Value Added (GVA) growth too came down sharply from 6.8% in Q1 to 5.8 %in this quarter. This has been worrisome to the policy makers and economic analysts, since this is evident of subdued domestic demand mainly from urban areas and a weaker manufacturing and construction activity.

Business activity in the manufacturing sector which has 14.3 % growth in 2023, was slashed down to 2.2 % in the current year, which depicts the problems of industries. Likewise in the construction side; growth rate reducing from 13.6 to 7.7% indicate urgency for immediate fiscal policies to stimulate industrial activities.

Sustaining Industries Presents Positive Aspects Despite Adversity

However, there was relative strength in the agriculture and allied activities, where growth rate reached 3.5 percent due to better monsoons and rural demand stimulus. Sustained investment also helped public administration, defence and allied services show higher performance as the GVAs rose from 7.7% to 9.2%. The sectors mentioned above have come out as key players in the small efforts to try and steady the economy when consumption and corporate returns in the urban areas had slowed down.

Major Issues and Forecasting and trends

The Reserve Bank of India (RBI) has left its FY/2012 growth estimate unchanged at 7.2% contingent on pulsating recovery during the second half of the current fiscal year. Urban demand, festive spending and better corporate performances are likely to be instrumental in driving this target. However, factors such us increasing input costs, deterioration in export demand and volatilities in the global economy may reverse the improvement.

Finally, Chief Economic Adviser V. Anantha Nageswaran described the decline as a one-off event, which results from some temporary factors. The authorities have emphasized the significance of the indication of invasive fiscal ratios including structural shifts to spur growth of manufacturing and other important sectors. Efforts to increase demand for consumption and investment outlay is being considered essential for the more sustained revival.

Policies Implications And Economic Reforms

To stimulate consumption, the government is aiming to stimulate the economy through fiscal policies such as improvement in expenses on infrastructure and rural development. Credit support and credit policy measures to improve industrial production could well be part of future policies. According to the Ministry of FinanceGDP growth for the year is forecasted to range between 6.5-7% depending on the second half recovery.

Policy Implications and Economic Reforms

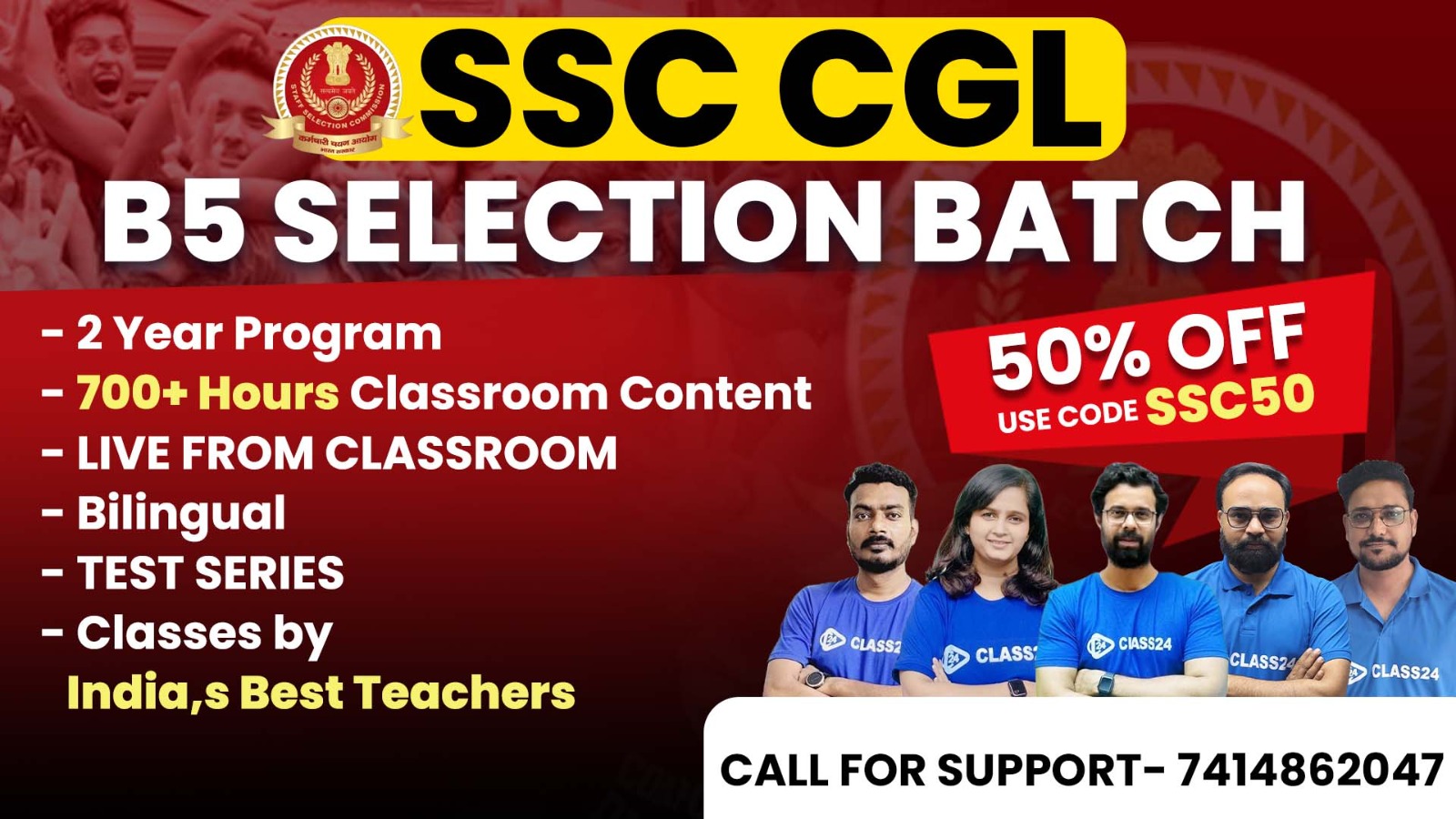

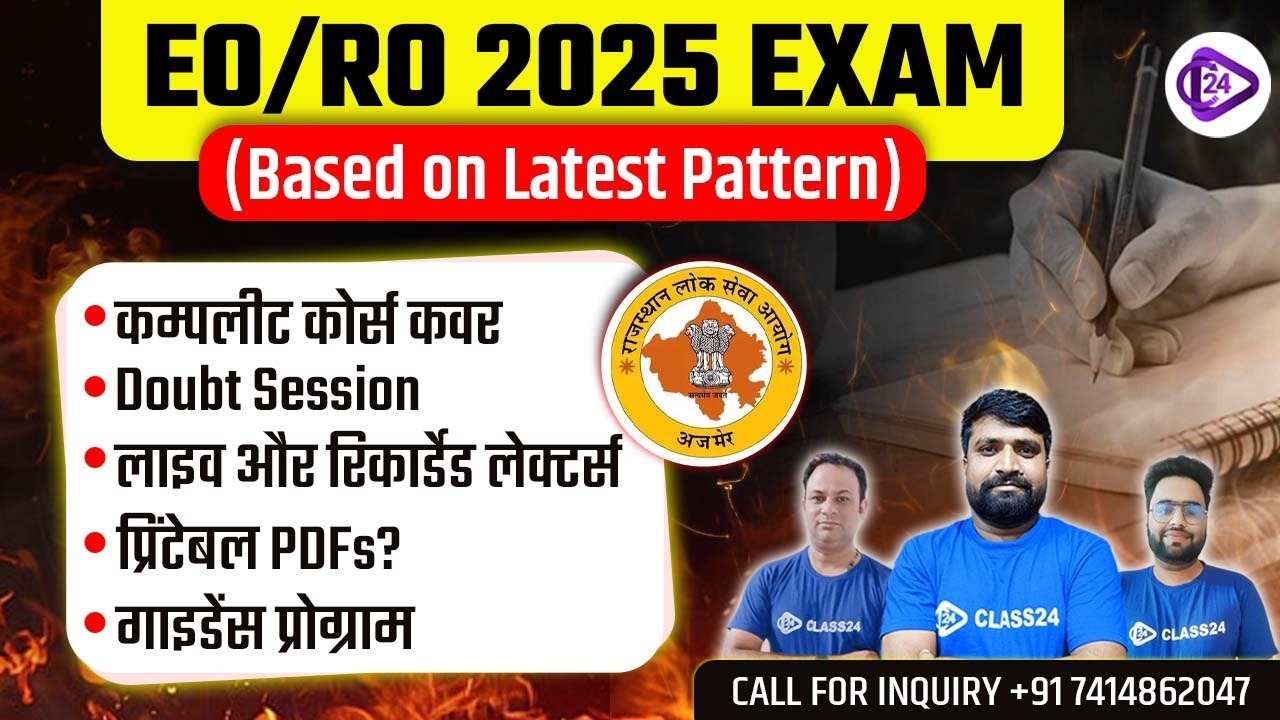

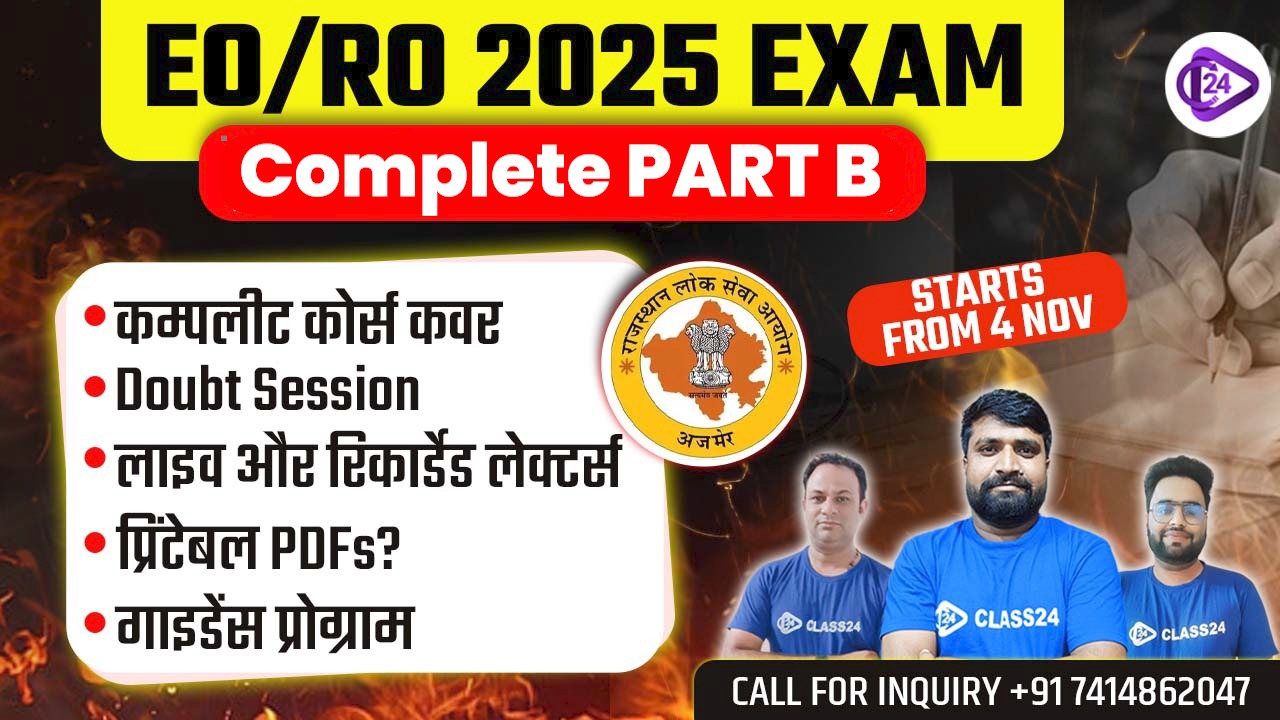

For the candidates appearing for SSC CGL, UPSC and other competitive examinations, it is important to have an insight on macro-economic parameters, effect of fiscal & monetary policies, and chief sectors, which is driving India’s economy. He smartly concentrates on the ideas such as GVA, GDP, and the position of the RBI in terms of the structuring of economic stability as they deeply belong to the GS Paper III (Economy) besides the economic parts in prelims and mains.

While this slow down in GDP growth rate can be worrisome it provides a chance to understand the process in India and the actions of government to counter the difficulties. The information will be critical for identifying the challenges India faces in balancing term growth and fiscal cycles, and how the country copes with adverse external economic environment whenever it occurs.

Chat With Us

India Fair Policies Global Plastic Treaty Negotiations

India Fair Policies Global Plastic Treaty Negotiations India Economic outlook RBI Monetary Policy 2024

India Economic outlook RBI Monetary Policy 2024 PAN 2.0 Transforming Indias Tax Administration Digital Reform

PAN 2.0 Transforming Indias Tax Administration Digital Reform Economic Stimulus Package Post COVID Growth India 2024

Economic Stimulus Package Post COVID Growth India 2024 Global Soil Conference 2024 Sustainable Soil Management

Global Soil Conference 2024 Sustainable Soil Management PM Vidyalaxmi Scheme Financial Assistance for Students

PM Vidyalaxmi Scheme Financial Assistance for Students