India and Russia have decided to alter the manner in which they conduct trades with one and other after 90% of these trades have moved away from the USD. This step relieves pressure on the use of such currencies as the US dollar and demonstrates a higher level of synchronization of the two partners’ economic plans. The transition was triggered by RBI recent move in February this year allowing India to make payments for imported goods in rupees RTGS and in June 2022 unrestricted invoicing in rupees.

In order to effect this change, Indian banks have opened 92 special rupee Vostro accounts in 20 AD banks across India. These accounts allow direct transfer of rupees for business with Russia to be made thus removing the need for third parties and variations in currency rates. This model has trickling attraction from other countries as well, at present banks from Bangladesh, Belarus as well as Botswana have been opening such accounts in India.

In the period between April and August of the financial year 2023-24, India has contracted $27.3bn worth of imports primarily consisting of petroleum, coal and fertilisers from Russia. This coincides with the rise of energy demand in India as well as the change in the energy mix import supplier. It also contain bilateral cooperation in particular fields of interest like the Northern Sea Route which focused on and aim at reducing the logistic costs, Nuclear Energy and Space which includes projects like Kudankulam Nuclear power project and India’s Gaganyaan Mission.

Relevance for Exams:

-

Prelims: Free access to India’s FTAs and strategic partners, rupee Vostro, and statistical download of major imports and exports.

-

Mains GS3: Evaluation of currencies plans, the state of independent India and Review of Diversification.

In addition, this shift not only enhances the bilateral relations between India and Russia in economic term but also enhances Indian desire to have more control on their financial and trade system. This essentially means that through this move, New Delhi is leaving nobody’s mercy and is well on course to setting up a solid defense mechanism on its currency front as well as building an even stronger international business bond with other nations, globally.

Chat With Us

Donald Trump high Traffics on Chinese Imports

Donald Trump high Traffics on Chinese Imports Nepal Bangladesh Power Cooperation Via India

Nepal Bangladesh Power Cooperation Via India Australia Mates Scheme Indian Graduates Career Opportunities

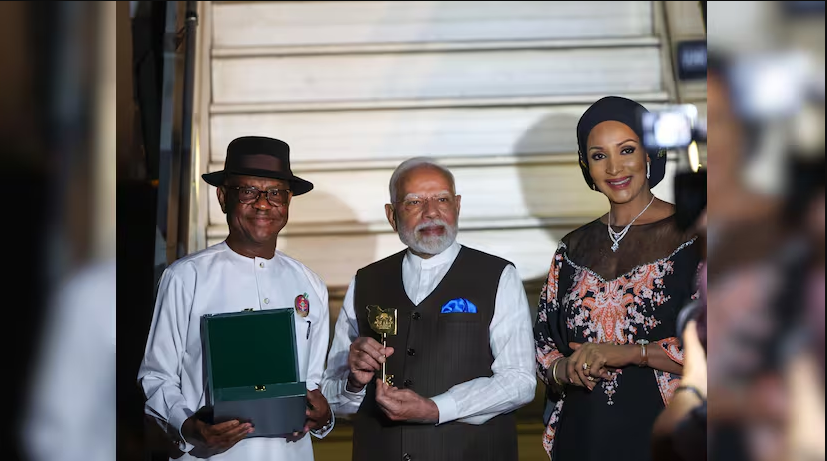

Australia Mates Scheme Indian Graduates Career Opportunities PM Modi Three-Nation Tour 2024

PM Modi Three-Nation Tour 2024 India and Japan Sign MoI for UNICORN Masts

India and Japan Sign MoI for UNICORN Masts NPP Victory Sri Lanka Parliamentary Elections

NPP Victory Sri Lanka Parliamentary Elections Amnesty Sudan Arms Embargo Violations

Amnesty Sudan Arms Embargo Violations Samantha Harvey Wins the 2024

Samantha Harvey Wins the 2024 Global CO2 Emissions Rise in 2024

Global CO2 Emissions Rise in 2024